Summary

In this episode of the First Choice FCU Newsletter, we look at spending and saving. We review The Fed and how rates can change. We also talk about something near and dear to us - teaching the youth of our community to be healthier with their money into adulthood!

A Letter from our CEO – A Dose of Reality

First Choice is the credit union for the School Districts in Lawrence County. While it is an honor to serve all of our members, we align closely with the principals of our educators. We feel that at the credit union we are to make education and consultation available to all of our members in order to assist them in their unique financial journey.

Soon we will begin a season of Reality Fairs. The Reality Fair Program was developed by our Pennsylvania State Credit Union Association (now known as CrossState) to partner with School Districts to provide supplemental financial education to students. While we have customized it to fit our geography, age, and time allocation, the program is typically targeted to Junior or Seniors in High School. We have been fortunate enough to present the principals of the program on College Campuses and in Elementary Schools.

In an ideal setting, we would have the opportunity to first discuss credit with the students and give them information about how a creditor views them. Armed with that information, students are able to understand how to present for future lending and avoid some common pitfalls. We discuss credit score, risk base pricing, debt management, and so much more.

From that initial meeting, we capture where the student wants to continue their education and what job / industry in which they are interested.

We then personalize a budget sheet that has a starting salary, student debt, credit card, and savings accounts. Armed with that information, we invite the students to the Reality Fair Event. Separate booths will be set up with our staff and volunteers. The students must visit each of the booths and make choices regarding what level of financial commitment they want to make at each booth. Booths include decisions about Housing, Transportation, Cell Phones, Insurance, Night Life, Clothing, Groceries, Furniture, etc.

After visiting all of the mandatory booths the students will then take their individualized sheet and visit with a Budget Counselor that will review their choices with them. The students will either then be congratulated for their financial responsibility, or in many cases, will be sent back to the booths to make other elections. The goal is to give the students a meaningful dose of “reality” with the security of knowledge that they are not yet responsible for any of these expenses.

In the best case scenario, a third meeting with the students would afford them the opportunity to reflect on their experience. The most common sentiment the students report, “I didn’t know my parents had to deal with all that.” We wrap up with a discussion about savings and properly preparing for retirement.

This interactive learning experience has proven to be relevant and impactful to the students. Some of my favorite memories over the past ten years has been my interactions with students and helping to ease some nerves. We are so fortunate to have great relationships with many of the Schools in our area.

Let’s Help The Big Man Out In 2026

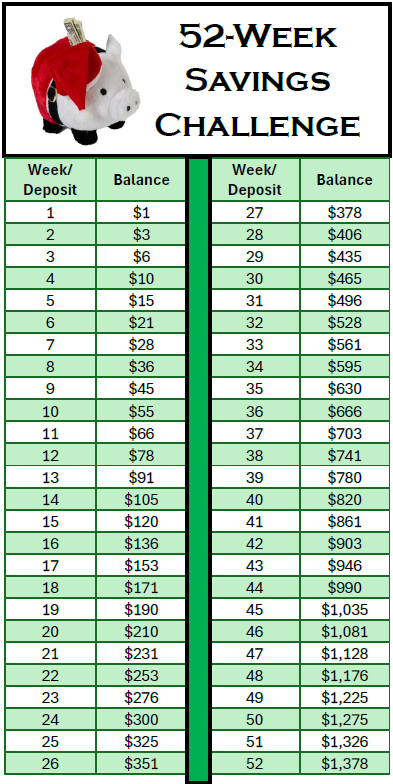

Even Santa needs a little extra help every now and then. Not to worry, we have a plan for you. If you start this week and save $1 in week 1; $2 in week 2; and so forth up to $52 in Week 52, you will be left with $1,378 (PLUS interest). That is a nice start to a full sleigh.

Wait, what week is it? Don’t worry, if you automatically transfer $26.50 as an automatic transfer, you will arrive at the same savings destination.

If you need help setting up that auto transfer, call one of our staff and we can help.

Let’s do our part to spread a little holiday cheer, and help those elves not have to lift so much next year.

You can start your own Christmas Club today!

Managing your Wealth – Tips from the Extremely Wealthy

Comedian Chris Rock brilliantly explained the difference between being Rich vs. being Wealthy. “Shaquille O’Neal is RICH. He has more money than he can spend in his lifetime. But the guy who pays Shaq is WEALTHY.”

If there is one key to financial success, of the wealthy, it can be summed up in one phrase: “Intentionally Live Below Your Means.” While many imagine wealth equating to lavish lifestyles, vacations, palatial homes, luxury cars, and limitless travel, most financially successful individuals are deliberate spenders.

Think of Warren Buffett, who still lives in the home he bought in 1958. True wealth builders make financial decisions based on value, not vanity. Did you know that the two most popular car brands for the Top 1%ers are Hondas and Toyotas. Jeff Bezos’ primary vehicle is a Honda Accord. Mark Zuckerburg drives his Toyota Camry to his appointments. Larry Page (CEO of Google) prefers a Prius. And Mr. Buffet likes the roominess of a Honda Pilot.

TIP: Competition to prove who has the bigger bank account often drains the account.

Wealthy People Plan for the Unexpected. Financial security includes protection. Those with wealth often carry insurance policies tailored to their assets. They maintain an emergency fund, and structure their holdings to guard against risk.

Tip: Use a mixture of insurance and savings to make sure you protect yourself. Whole and Term insurance policies are useful, but they have different aims. Term often expires and is intended to supplement income for your family in case of loss. A good rule of thumb is to have enough insurance to pay off asset debt (i.e. house, cars) if the “God forbid” tragedy happens.

TIP: The best time to get insurance (and supplemental insurance) is when you are young… rates are the best, and often times locked in. Nobody wants the worst, but planning for it and having enough reserves to weather the storm are important decisions for you and your families future.

Wealthy people often Think Beyond Themselves. Generational wealth isn’t an accident. Many wealthy

people will invest in assets that appreciate: homes, land, blue chip investment. However, according to Wealth-X, 70% of affluent (rich) families lose their wealth by the second generation, and 90% by the third – usually due to a lack of financial education.

TIP: Start the conversation with your children or grandchildren about money by introducing them to basic budgeting tools and encouraging smart saving habits from a young age.

Wealthy people often understand Patience is the Key to Let Things Grow. Children don’t mature overnight. Mighty oaks don’t go from acorn-to-tree in mere days. Adopting a long-term mindset and prioritizing consistent improvement over wild (unsustainable) gains is the best way to see results multiply. Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… how who doesn’t, pays it.”

TIP: Invest and let your money grow. If you are too reactionary, your money does not have time to mature. Chasing gains is a short-term strategy. Prioritize consistent steady growth and allow your money to incubate.

What if you are not even RICH at this point? Start. None of these tips are reserved to the ultra-elite. There is nothing wrong with making money the old-fashioned way… working for it. Now, build in the habits to let your money work for you. Don’t keep up with the Joneses; Save for an emergency fund; Prepare your kids to be savers; Don’t try and “time the market”, allow your retirement to grow consistently over time. Start small, get a savings account, and then a CD, and then an investment, but the point is to start. We will help!

Sometimes It Cuts Both Ways

On September 17, 2025 the Federal Reserve (Fed), as expected, cut rates by 0.25%, citing a slowing labor market, which outweighed ongoing inflationary concerns.

What does this mean to the average consumer? Almost immediately you will see savings rates decline. If you are a CD Rate shopper, you are probably not likely to see a lot of rates start with the number “4”. Upper “3”s is where you are likely to get your best value at this time.

So that must mean that rate cuts are bad for the economy… not exactly. While it is difficult news for savers, lending rates will slowly begin to trend down as pressure mounts from competition. Lower lending rates means money should “flow” easier, not just for consumers, but also for business. Businesses, no longer making as much money in investments, will be encouraged to “use” their reserves and invest in their workers, property, and equipment. This, in turn, will inject more money into the economy and ultimately lend stability to the job market.

Will the 0.25% rate cut be enough to stabilize the market? Probably not. The Fed will likely space out their cuts and allow the effects to build over time. Being too aggressive with cutting the rates could have unintended and unpredictable consequences. Therefore, slow and methodical is normally the approach.

What should you do now? Invest. If you are a saver and not in the stage of life where you need to “acquire”, with rates threatening to lower again, now is the time to lock-in some savings. Look for that sweet spot of rate and longer term. Check out our latest offering. We make it a point to be very competitive in the CD market.