A letter from our CEO – A Year In Review

It is hard to believe that another year has passed us by. It is a natural time of reflection at the first of the year to look back and appreciate the good, mourn the losses, and determine to make changes for the future.

In 2024, we welcomed over 600 new friends to our Credit Union. We grew our deposit base, in part, by continuing to offer some of the best CD rates in our area. We wrote nearly 800 loans. While it is easy to think of those loans as just another “Used Car” or “Home Equity Loan”, they really represent 800 dreams that we helped come true. Some of those vehicles were to first time buyers, that will now be used to get that person back and forth to their first job. Others represented the 40th loan that a member had with us. That level of trust and loyalty is not lost on us.

Many of you know that I used to work at a really large bank before returning to First Choice. I was a pretty good lender and I had one of the highest “return customer” percentages in the company. I almost got to 20%, but not quite. Here at the credit union, if a member gets that first loan with us, they are 60% likely to return. Sure, we understand that we have good rates, and that translates into lower payments and stronger budgets for our membership, but we also like to think that it is because we deliver pretty good member service. We try and approach each loan with the same consultative mentality that we would our own friends and family members. We DO NOT look at our members are profit generators; we look at them as they actually are: sons and daughters, parents doing their best to meet all of the demands, grandparents on a fixed income with real needs.

Sadly, we had to say goodbye to some wonderful members that we truly enjoyed taking care of over the years. When we say, “no one is just a number here”, it is funny to realize how deeply you can form a relationship with people just from service interactions. Over the years we have become part of their lives. Many of these members helped define who we are and gave us the motivation to challenge ourselves to be able to serve them more.

We want to thank all of our members for being the heartbeat of what we do. For the past 72 years we have attempted to serve all of you and your family’s financial needs.

We consider it an honor to serve our members and this Community. We look forward, with great anticipation, to the future. We are committed to continuously improve ourselves; to add new products and services; to keep our rates, on both the deposit and lending side, at or near the best in our area. We also commit to being real people recognizing that we serve the same. We are committed to you. If you have only “dipped your toe” into the credit union experience, it is time to dive into the deep end. We will see you soon in 2025.

Stay Alert – A message on security

The holidays are a time for joy, peace, family gatherings, and unfortunately an increase in fraud, scams, and phishing threats.

How many text messages have you received demanding information to “complete your order” or else the item will be sent back?

Additionally, soon we will be entering the season of IRS Scams. There was a miscalculation and either you are owed lots of money (so give us your account information) or you are so far behind on payment that you will immediately be heading to jail (unless you give them your account information).

Life is hard enough without these fraudsters trying to make it even harder.

Here are a few things you should consider to protect yourself.

Use strong passwords

Most places today have a requirement regarding how many characters are required. And just like you, I have a ton of passwords that need to be changed every 30 days… and “the mother of all sticky notes” where my identity resides. However, at the risk of sounding hypocritical, you need to vary the password origination. We are all creatures of habit, so what likely happens is we use the same root password for everything. What if a fraudster somehow gets that password? Then with subtle changes they can have access to everything.

When entering passwords, try and use a Secure Wifi connection

If you are at Starbucks, Panera, or McDonalds and can connect to the internet without a password, everyone is sharing the same network. If you enter your bank information while sitting enjoying a latte, that information can be captured. Just because you don’t know how to do it, doesn’t mean the technology doesn’t exist.

Use apps for added security

When possible use apps instead of websites that utilize facial recognition or biometrics. When that is not possible use websites that offer MFA (Multi-Factor Authentication) where they send you a code in order to gain access to your accounts. This helps to ensure it is you doing the business.

Don’t believe everything

Always be cautious of unsolicited text messages or links in an e-mail that create a sense of urgency. Fraudsters use something called “social engineering” to gather data about you so they become aware of patterns that you use or websites that you frequent.

Monitor your accounts

If there are things you do not recognize, call the number on that statement to see what they are. Call your credit union if you need help.

Keep everything updated

I KNOW it is a pain, but you need to keep your phones and software updated. Most of the software updates include enhanced security features to combat new or known threats.

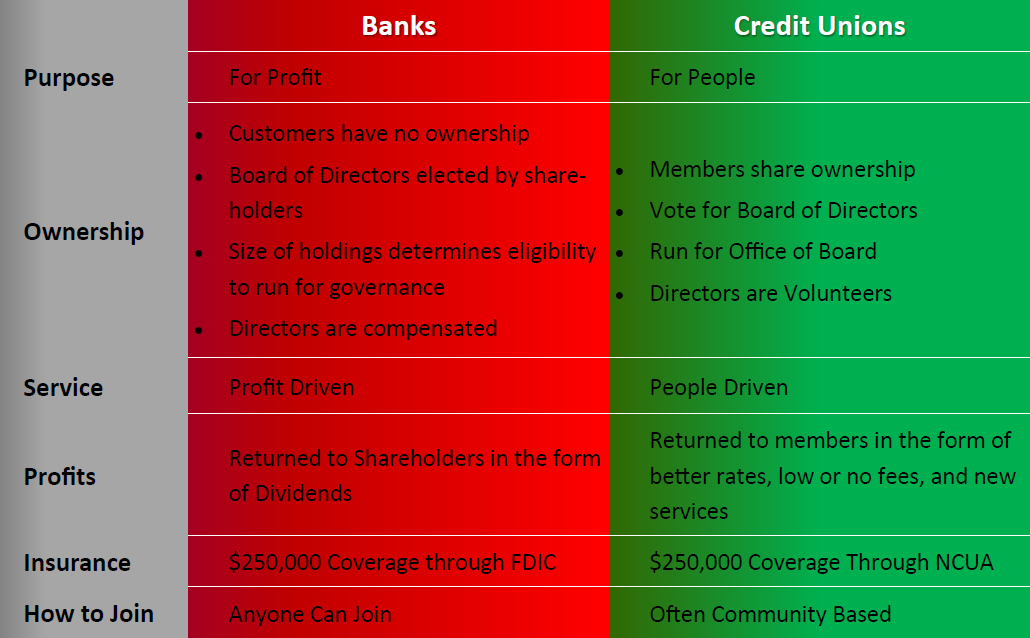

Banks vs. Credit Unions – An Easy Explanation

Carrot versus Stick

Both banks and credit unions would love for you to bank with their institution, but our motivations are different.

Banks attempt to modify your financial behaviors with a stick mentality. They will offer you a “free” account, but first you have to maintain a certain (often high) balance or direct deposit requirement.

Many banks will place an emphasis on fees structures. Credit unions try and work with members to eliminate fees. Many of First Choice fees are “annoyance fees”. For instance, we charge $2 for a dormant account so that we encourage people not to have their money escheated to the State as is Federally required if any account is abandoned. We are not getting rich, $2 at a time, we are simply trying to spur people to action.

Some banks have even started to charge their customers for using tellers as opposed to technology.

Our approach is to treat everyone fairly, with respect, and reward our members who choose to bank with us. The more you are with us, the more we are with you.

Humbled By Your Generosity

This year the Board and staff determined that they wanted to give back to the Community. Rather than exchange gifts at our Christmas Party, they wanted to take that money and find a way to bless others. Pizza Man Pizza organized a local Veteran Drive for which we adopted six of those who proudly served.

Additionally, we selected The Neighborhood Pantry which has served Lawrence County and it’s residence for over 15 years, supporting those with basic food and resource needs year-round. In the last several years they have opened “The Neighborhood Link”, as a thrift store whose proceeds are used to buy food for the Pantry.

We opened up this opportunity for our members to participate in this giving and you did not disappoint. Many of our members brought in food stocks or contributed monetarily to this worthwhile Community Reinvestment Charity.

A special thanks to R Cunningham Funeral Home and Crematory for embracing this outreach and becoming an alternative location to drop off donations.

What An Honor

For the second straight year we have been selected by Newsweek as one of the Top Regional Credit Unions. This honor is bestowed to 250 Regional Banks and Credit Unions across the Country. Only 40% of those awarded are repeat winners.

We recognize that without our members, we could not achieve this honor. Thank you all for you business and support.